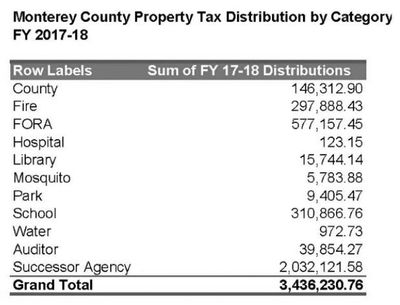

monterey county property tax due dates

Receive a good insight into real estate taxes in Monterey County and what you should understand when your. A convenience fee is charged for paying.

Monterey County California Genealogy Familysearch

If ordered by board of supervisors first installment real property taxes and first installment one half personal property taxes on the secured roll are due.

. Property taxes are levied on property as it exists on January 1st at 1201 am. The Tax Collector processes all real estate personal property tax bills payments. Real Estate Personal Property Tax Bills are quarterly and are due on.

The taxes are late if the first half is not paid by April 30th. All major cards MasterCard American Express Visa and Discover are accepted. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and.

January 1 - Lien date the date taxable value is established and property taxes become a lien on the property. Choose Option 3 to pay taxes. You can call the Monterey County Tax Assessors Office for assistance at.

16 rows First installment of secured property taxes is due and payable. Monterey County 31 Mar The SECOND INSTALLMENT payment for annual property taxes was due on February 1 2021 and will become delinquent if not paid by 500 pm. First installment of secured property taxes payment deadline.

For secured property the first installment is due and payable on November 1st and becomes delinquent if not paid by. You will need your 12-digit ASMT number found on your tax bill to make payments. The second payment is due september 1 2021.

Yes you can pay your property taxes by using a DebitCredit card. Tax bills are generated every fiscal year July 1 through June 30 and mailed in mid. Monterey County Property Tax Due Dates.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. Tax bills are generated every fiscal. Property Taxes Due Dates.

When are property taxes due in Monterey County. July 1 - Beginning of the Countys fiscal year. 1-831-755-5057 - Monterey County Tax Collectors main telephone number.

The second installment is due March 1 of the next calendar year. Property taxes are due january 1st for the previous year. Ultimate Monterey County Real Property Tax Guide for 2022.

When contacting Monterey County about your property taxes make sure that you are contacting the correct office. If the Form 11 is mailed after April 30 of the assessment year the filing deadline is. If the Form 11 is mailed before May 1 of the assessment year the filing deadline is June 15 of that year.

August 1st November 1st February. On April 12 2021. The second payment is due september 1 2021.

The first installment is due September 1 of the property tax year. A 25 percent discount is allowed for first-half property taxes. Secured property taxes are levied on property as it exists on January 1st at 1201 am.

First installment of secured property taxes payment deadline.

Brown County Property Taxation

Treasurer Tax Collector Monterey County Ca

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Calfresh Monterey County 2022 Guide California Food Stamps Help

Property Tax Deadline Approaching County Of San Luis Obispo

United Way Monterey County Offering Free Tax Prep For Residents Kion546

Monterey County Cannabusiness Law

Monterey County Assessor Office 12 Photos 168 W Alisal St Salinas Ca Yelp

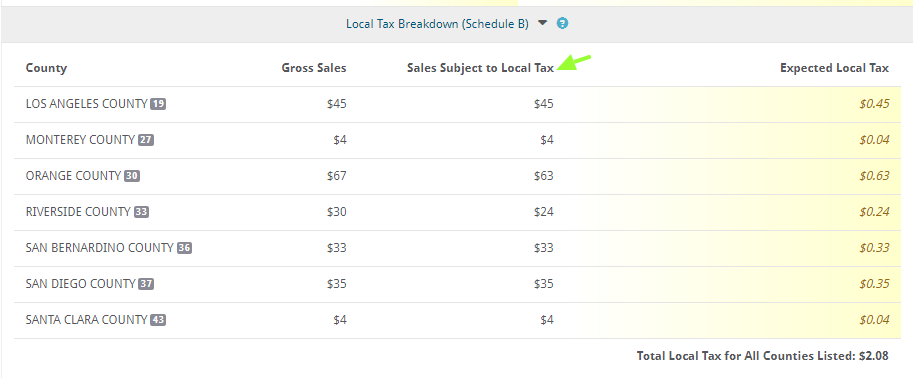

How To File A California Sales Tax Return Taxjar

Monterey County News Briefing 6 22 22 Youtube

Monterey County Ca Land For Sale 282 Listings Landwatch

Calfresh Monterey County 2022 Guide California Food Stamps Help

More Property Tax Relief Available To Monterey County Homeowners The King City Rustler Your Local News Source In King City California

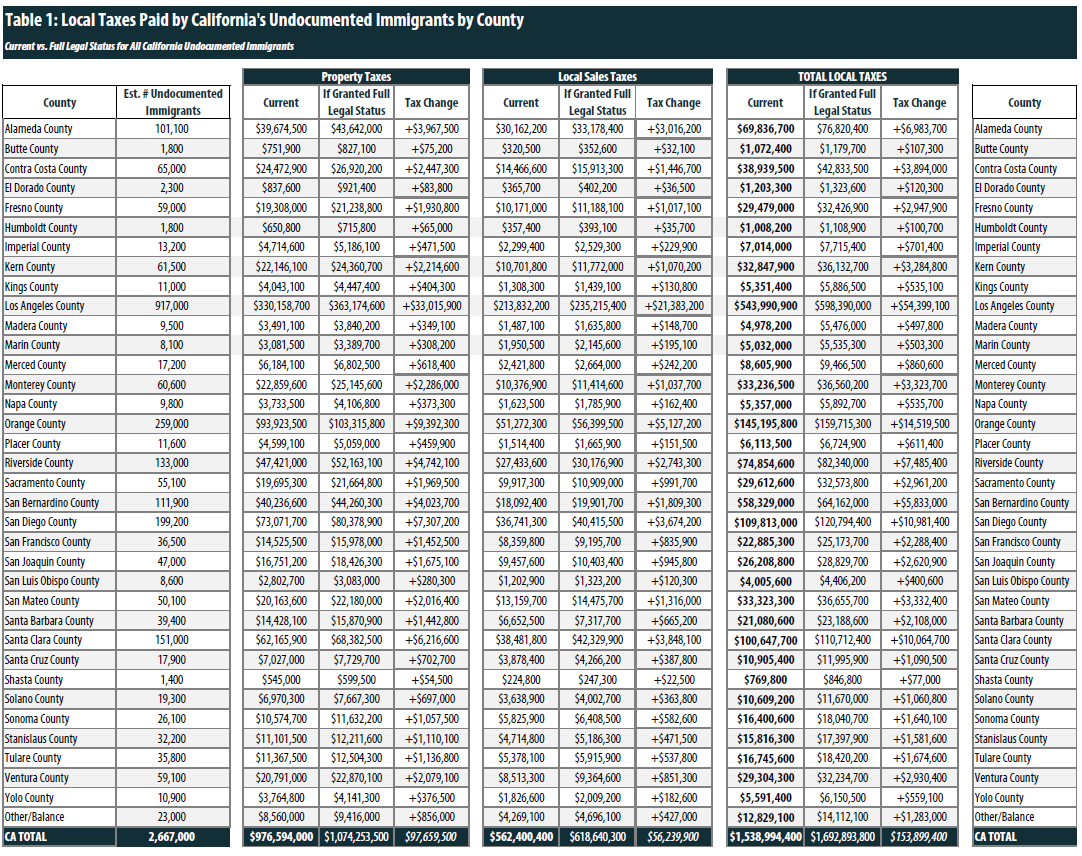

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep